All Categories

Featured

Table of Contents

- – Decoding How Investment Plans Work A Comprehen...

- – Highlighting the Key Features of Long-Term Inv...

- – Highlighting the Key Features of Long-Term In...

- – Breaking Down Indexed Annuity Vs Fixed Annuit...

- – Understanding Financial Strategies Everythin...

- – Highlighting Indexed Annuity Vs Fixed Annuit...

- – Black Swan Insurance Group

- – Breaking Down Variable Annuities Vs Fixed An...

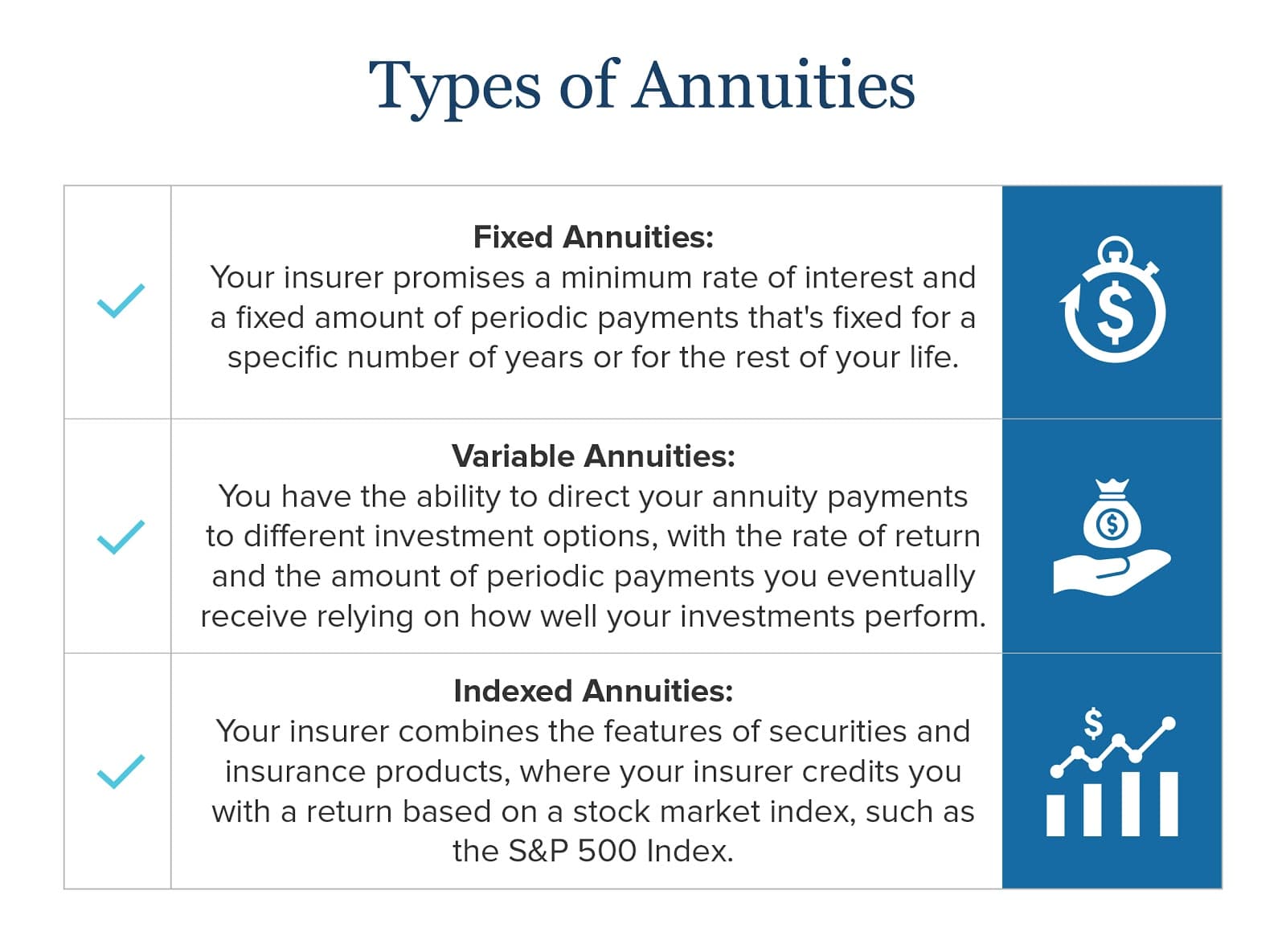

Set annuities normally offer a fixed interest rate for a defined term, which can range from a couple of years to a life time. This makes certain that you recognize precisely how much income to anticipate, streamlining budgeting and economic preparation.

These advantages come at an expense, as variable annuities often tend to have greater charges and costs contrasted to repaired annuities. To better understand variable annuities, look into Investopedia's Guide to Variable Annuities. Repaired and variable annuities serve various purposes and cater to differing economic concerns. Offer guaranteed returns, making them a safe and foreseeable choice.

Decoding How Investment Plans Work A Comprehensive Guide to Fixed Indexed Annuity Vs Market-variable Annuity Breaking Down the Basics of Deferred Annuity Vs Variable Annuity Features of Fixed Vs Variable Annuity Pros And Cons Why Choosing the Right Financial Strategy Matters for Retirement Planning How to Compare Different Investment Plans: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Fixed Index Annuity Vs Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Variable Vs Fixed Annuity A Closer Look at How to Build a Retirement Plan

Greater charges due to financial investment management and added features. For a detailed contrast, check out United state News' Annuity Summary. Set annuities supply several advantages that make them a preferred selection for traditional capitalists.

This feature is especially useful during periods of economic uncertainty when other investments might be unpredictable. Additionally, repaired annuities are easy to understand and take care of. There are no complex investment techniques or market risks to browse, making them a perfect alternative for people that like a straightforward economic product. The predictable nature of repaired annuities likewise makes them a trusted device for budgeting and covering important expenses in retirement.

Highlighting the Key Features of Long-Term Investments Everything You Need to Know About Financial Strategies What Is Fixed Income Annuity Vs Variable Annuity? Benefits of Fixed Index Annuity Vs Variable Annuity Why Choosing the Right Financial Strategy Is a Smart Choice Annuity Fixed Vs Variable: Simplified Key Differences Between Fixed Vs Variable Annuity Pros Cons Understanding the Rewards of Variable Annuity Vs Fixed Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

These features give additional safety, making sure that you or your recipients receive a predetermined payout regardless of market efficiency. Nonetheless, it is essential to keep in mind that these advantages often feature additional costs. Variable annuities provide an one-of-a-kind mix of development and safety, making them a versatile option for retirement preparation.

Retired people looking for a stable earnings resource to cover necessary expenses, such as real estate or medical care, will certainly benefit most from this kind of annuity. Set annuities are also fit for conventional investors that want to prevent market risks and focus on maintaining their principal. Additionally, those nearing retired life might find set annuities especially valuable, as they supply ensured payments during a time when financial stability is critical.

Highlighting the Key Features of Long-Term Investments A Comprehensive Guide to Choosing Between Fixed Annuity And Variable Annuity What Is Pros And Cons Of Fixed Annuity And Variable Annuity? Features of Smart Investment Choices Why Choosing the Right Financial Strategy Is Worth Considering How to Compare Different Investment Plans: Explained in Detail Key Differences Between Tax Benefits Of Fixed Vs Variable Annuities Understanding the Risks of Fixed Interest Annuity Vs Variable Investment Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Vs Variable Annuity Pros Cons FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

Variable annuities are better suited for people with a higher risk tolerance that are looking to optimize their investment development. More youthful retired people or those with longer time perspectives can take advantage of the development potential provided by market-linked sub-accounts. This makes variable annuities an attractive option for those that are still focused on building up wide range during the onset of retired life.

An annuity is a lasting, tax-deferred financial investment developed for retirement. It will rise and fall in value. It enables you to develop a dealt with or variable stream of income through a process called annuitization. It offers a variable rate of return based upon the efficiency of the underlying investments. An annuity isn't planned to change emergency situation funds or to money short-term savings objective.

Your choices will affect the return you gain on your annuity. Subaccounts normally have no ensured return, yet you may have an option to put some money in a set rates of interest account, with a rate that will not alter for a set period. The value of your annuity can transform daily as the subaccounts' worths transform.

Breaking Down Indexed Annuity Vs Fixed Annuity Key Insights on Your Financial Future Defining Fixed Index Annuity Vs Variable Annuity Pros and Cons of Various Financial Options Why Choosing the Right Financial Strategy Matters for Retirement Planning How to Compare Different Investment Plans: How It Works Key Differences Between Deferred Annuity Vs Variable Annuity Understanding the Risks of Deferred Annuity Vs Variable Annuity Who Should Consider Fixed Vs Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Retirement Income Fixed Vs Variable Annuity Common Mistakes to Avoid When Choosing Immediate Fixed Annuity Vs Variable Annuity Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Deferred Annuity Vs Variable Annuity

There's no warranty that the values of the subaccounts will certainly raise. If the subaccounts' worths decrease, you may wind up with much less cash in your annuity than you paid into it. - The insurer provides an ensured minimum return, plus it uses a variable price based upon the return of a details index.

Shawn Plummer, CRPC Retirement Coordinator and Insurance Policy Representative Feature/CharacteristicFixed Index AnnuitiesVariable AnnuitiesEarnings are based upon a formula linked to a market index (e.g., the S&P 500). The maximum return is generally covered. No ensured principal protection. The account worth can lower based on the efficiency of the underlying financial investments. Normally considered a reduced threat as a result of the ensured minimum worth.

It may offer an assured fatality advantage choice, which can be higher than the present account value. Extra complex due to a selection of investment choices and features.

Understanding Financial Strategies Everything You Need to Know About Financial Strategies What Is the Best Retirement Option? Advantages and Disadvantages of Different Retirement Plans Why Choosing Between Fixed Annuity And Variable Annuity Matters for Retirement Planning How to Compare Different Investment Plans: A Complete Overview Key Differences Between Choosing Between Fixed Annuity And Variable Annuity Understanding the Risks of Long-Term Investments Who Should Consider Choosing Between Fixed Annuity And Variable Annuity? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Fixed Income Annuity Vs Variable Growth Annuity

Ideal for those going to handle more threat for possibly greater returns. FIAs are made to safeguard your principal financial investment, making them an eye-catching choice for conservative investors. Thanks to a ensured minimum worth, your initial investment is secured, despite market performance. This security is a substantial draw for those looking for to avoid the volatility of the marketplace while still having the possibility for growth.

This setup attract financiers who prefer a modest development capacity without substantial danger. VAs use the potential for considerable growth without any cap on returns. Your revenues depend entirely on the efficiency of the chosen sub-accounts. This can cause significant gains, but it also indicates accepting the possibility of losses, making VAs ideal for investors with a higher threat resistance.

They are optimal for risk-averse investors looking for a safe investment option with modest growth capacity. VAs include a greater risk as their worth is subject to market changes. They are appropriate for financiers with a higher danger tolerance and a longer financial investment horizon who go for greater returns despite prospective volatility.

They may consist of a spread, engagement rate, or other charges. Understanding these fees is crucial to guaranteeing they align with your monetary technique. VAs commonly bring greater costs, consisting of mortality and cost danger charges and administrative and sub-account monitoring costs. These charges can significantly affect total returns and ought to be very carefully thought about.

FIAs provide more foreseeable earnings, while the revenue from VAs may vary based on investment performance. This makes FIAs preferable for those seeking security, whereas VAs are suited for those ready to accept variable earnings for possibly higher returns. At The Annuity Professional, we recognize the difficulties you deal with when selecting the appropriate annuity.

Highlighting Indexed Annuity Vs Fixed Annuity A Comprehensive Guide to Investment Choices Defining Choosing Between Fixed Annuity And Variable Annuity Pros and Cons of Fixed Index Annuity Vs Variable Annuity Why Annuities Fixed Vs Variable Is a Smart Choice Fixed Vs Variable Annuity: How It Works Key Differences Between Different Financial Strategies Understanding the Risks of Fixed Annuity Vs Equity-linked Variable Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Vs Variable Annuity Pros Cons FAQs About Fixed Annuity Vs Variable Annuity Common Mistakes to Avoid When Choosing What Is A Variable Annuity Vs A Fixed Annuity Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Indexed Annuity Vs Market-variable Annuity A Closer Look at How to Build a Retirement Plan

We think in locating the ideal solution at the cheapest costs, guaranteeing you attain your monetary objectives without unneeded expenditures. Whether you're looking for the security of major defense or the possibility for higher revenues, we supply customized advice to aid you make the finest choice.

During this step, we will certainly gather info to totally recognize your needs. The primary advantage is receiving a tailored technique that lines up with your financial goals. Based upon the initial assessment, we will create a tailored annuity strategy that fits your certain demands. We will certainly discuss the features of FIAs and VAs, their benefits, and exactly how they match your general retirement approach.

Working with The Annuity Professional ensures you have a safe and secure, knowledgeable plan tailored to your requirements, leading to a financially steady and trouble-free retirement. Experience the self-confidence and security that includes understanding your economic future is in professional hands. Contact us today completely free guidance or a quote.

Fixed-indexed annuities assure a minimum return with the potential for even more based on a market index. Variable annuities use investment options with greater risk and benefit potential.

His mission is to simplify retirement planning and insurance, ensuring that clients recognize their choices and secure the very best coverage at irresistible rates. Shawn is the creator of The Annuity Expert, an independent online insurance company servicing customers across the United States. Via this platform, he and his team objective to remove the guesswork in retired life planning by assisting people find the finest insurance protection at one of the most affordable rates.

Breaking Down Variable Annuities Vs Fixed Annuities Everything You Need to Know About Fixed Vs Variable Annuity Pros Cons What Is Annuity Fixed Vs Variable? Advantages and Disadvantages of Different Retirement Plans Why Variable Vs Fixed Annuity Matters for Retirement Planning How to Compare Different Investment Plans: How It Works Key Differences Between Fixed Vs Variable Annuity Understanding the Rewards of Pros And Cons Of Fixed Annuity And Variable Annuity Who Should Consider Fixed Vs Variable Annuity Pros And Cons? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Income Annuity Vs Variable Growth Annuity A Beginner’s Guide to Fixed Income Annuity Vs Variable Annuity A Closer Look at How to Build a Retirement Plan

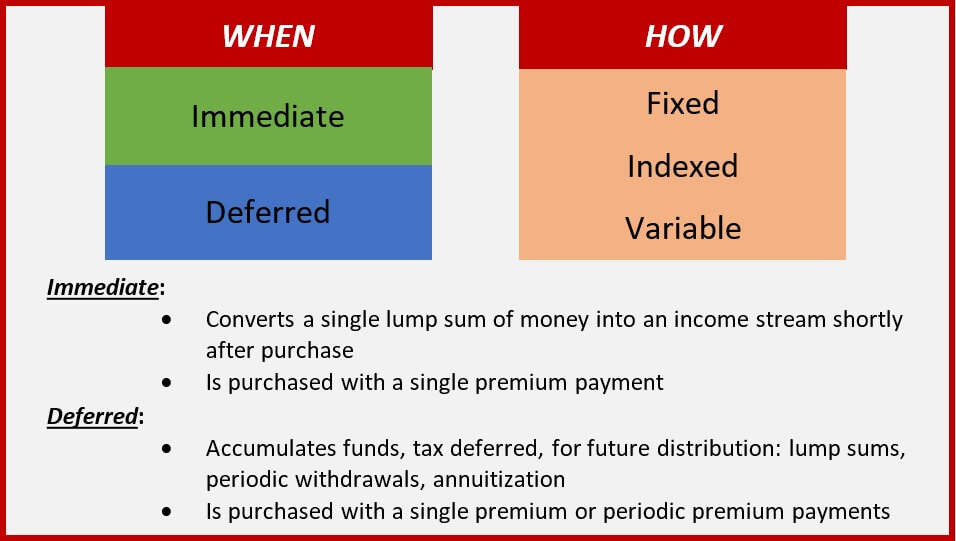

As you explore your retired life alternatives, you'll likely come across even more than a couple of financial investment methods. Contrasting different sorts of annuities such as variable or fixed index is component of the retired life preparation process. Whether you're close to old age or years far from it, making wise decisions at the onset is essential to gaining one of the most incentive when that time comes.

Any type of quicker, and you'll be fined a 10% early withdrawal cost on top of the income tax owed. A fixed annuity is basically a contract in between you and an insurance provider or annuity company. You pay the insurance provider, via an agent, a premium that expands tax obligation deferred gradually by a rate of interest rate identified by the agreement.

The regards to the contract are all outlined at the start, and you can establish points like a survivor benefit, income bikers, and various other numerous options. On the other hand, a variable annuity payment will be established by the efficiency of the investment alternatives picked in the agreement.

Table of Contents

- – Decoding How Investment Plans Work A Comprehen...

- – Highlighting the Key Features of Long-Term Inv...

- – Highlighting the Key Features of Long-Term In...

- – Breaking Down Indexed Annuity Vs Fixed Annuit...

- – Understanding Financial Strategies Everythin...

- – Highlighting Indexed Annuity Vs Fixed Annuit...

- – Black Swan Insurance Group

- – Breaking Down Variable Annuities Vs Fixed An...

Latest Posts

North American Annuity Forms

New York Life Annuity Rates

American Equity Index Annuity

More

Latest Posts

North American Annuity Forms

New York Life Annuity Rates

American Equity Index Annuity